Mastercard released its 2016 Global Destination Cities Index (GDCI) this week.

Cities in Motion: Global Economic Changes Drive Regional Dynamics

Now in its seventh year, the Global Destination Cities Index (GDCI) has transcended the race to the number one ranking. Yes, it’s an honor to be known as the world’s most visited city (Bangkok). And to be recognized as the fastest-growing destination (Osaka) is a confimation of capturing new dynamics and smart infrastructure management. But it’s the stories within that distinguish this year’s report and accentuate the wealth of data behind it.

As a tracking study of international travel destinations, cross-border spend, and the internal patterns, the 2016 report has a mass of data that show appreciable trends and impactful stories. The Mastercard GDCI shows three distinct story lines for 2016.

One: The growth trajectory of cities outside of the top 20 list.

Two: The deeper insights into the motivations and travel spend behavior of visitors to those cities.

Three: Changes in regional dynamics, especially in the Asia-Pacifi c region. Government offi cials, travel executives, and other sectors of business will fi nd that this year’s report refl ects the changing nature of regional markets and illustrates the unpredictable nature of the global consumer.

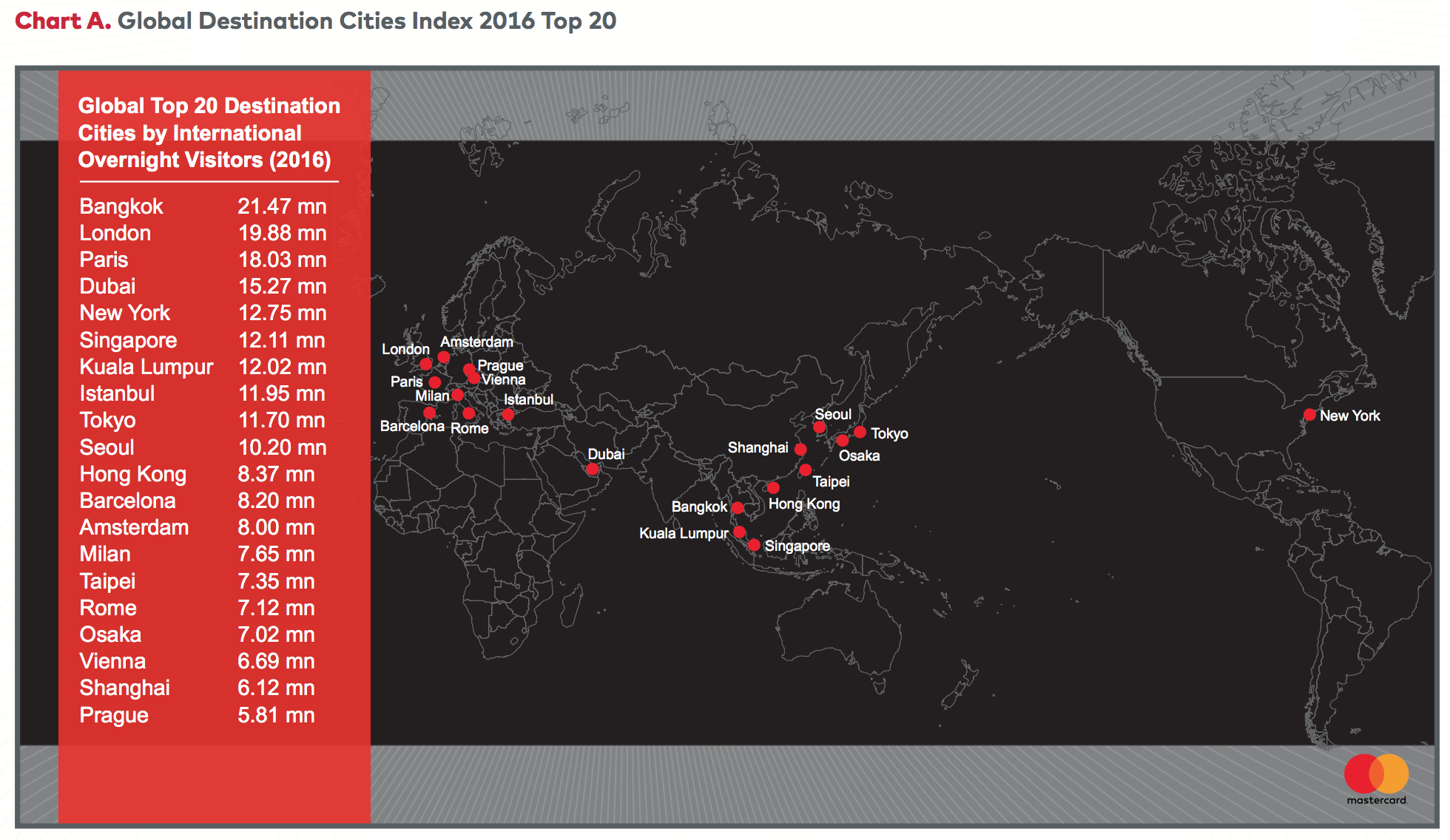

Although the study shows these “below the radar” markets, it is important to note the composition of the top cities in the Index. Here the key metric is international visitors, in which Bangkok has achieved the top-ranked position in 2016. Dubai is top ranked in the Middle East & Africa (MEA) region (and ranked fourth globally). London is the top-ranked in Europe in international visitors and ranked second globally. Lima is top ranked in Latin America. New York tops North America (ranked fi fth globally). In terms of visitor spending, also a critical metric, Dubai made a quantum leap to become the global top-ranked, based on a new estimate provided by the Dubai government. London ranks second in terms of visitor spend, followed by New York, Bangkok, and Paris.

Regional Dynamics

Regional analysis shows similar change, most dynamic in Asia-Pacific. In this region, the fastest-growing destination city is Osaka. That’s surprising because while its growth rate is the fastest, it still does not rank in overall volume.

It currently ranks only eighth in the region. Six of the 10 fastest-growing destination cities in Asia-Pacific are not among the current regional top 10, and many of these are cities in China. In Europe, the fastest-growing destination

city is Hamburg—again, not among Europe’s top 10 today. Eight of the 10 fastest growing European destination cities are not among the current regional top 10, with Eastern European cities the most prominent among them.

On the contrary, Latin America aligns with overall spend and visitor volume. The current top-ranked destination city in the region, Lima, is also the fastest growing. In fact, there is a complete overlap between the current regional top-ranked cities and the fastest-growing cities in Latin America. In the Middle East & Africa region, the fastest-growing destination city is Abu Dhabi, which ranked fourth in the regional top 10 currently. In MEA there is also a complete overlap between the current regional top-ranked destination cities and the fastest-growing in the region. The overlap does not exist in North America, where the fastest-growing destination city in the region is Houston, which is not even among the current regional top 10. Apart from Houston, Atlanta is also among the fastest-growing destination cities that is not among the current regional top 10.

These growth trends are powerful indicators of the accelerating pace of change among the destination cities.

Even as the current patterns of connectivity between these cities continue to deepen, powerful forces are at work in ramping up new connections and expanding existing ones such that many emergent destination cities, especially in Asia-Pacific (especially China) and Europe (especially Eastern Europe), are poised to overtake the current leaders in the coming years.

Global Ranking by Visitors: Bangkok Takes Global Top Rank

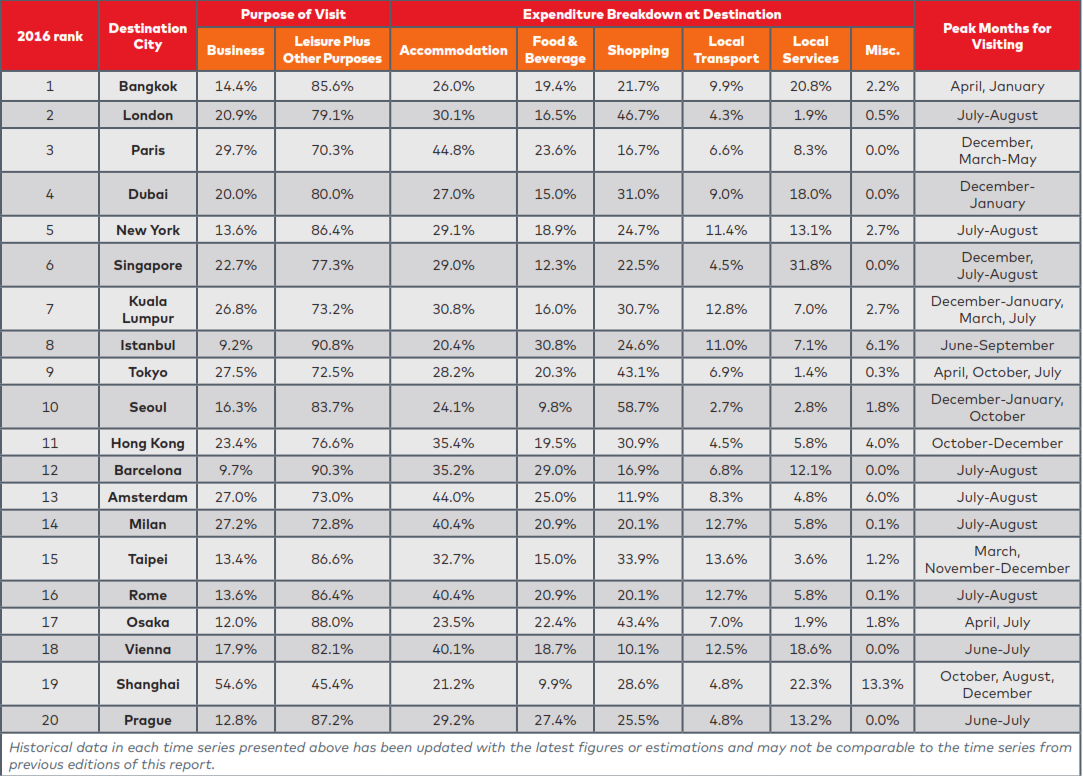

Overall rankings show that Bangkok has achieved the top-ranked position in 2016 with 21.47 million overnight visitors.2 Singapore and Kuala Lumpur moved up one rank to sixth and seventh rank respectively, while Istanbul dropped from sixth to eighth rank. Barcelona moved up one place to 12th rank, replacing Amsterdam. Similarly, Taipei moved up to 15th rank, replacing Rome; and Osaka moved up to 17th rank, replacing Vienna. Chart 2 provides more details on the global top 20 destination cities and starts to show some of the individual destination growth. Among these top 20 cities, Osaka posted the strongest growth in international visitors at 13.3% over the 2015/2016 period (as shown in chart 4 on page 8, Osaka is actually the fastest-growing destination city over the 2009–2016 period among the 132 cities with at least one million overnight visitors in 2016), followed by Tokyo at 12.2% and Seoul at 10.2%. Bangkok’s growth rate is 9.6%, putting it as the fourth fastest-growing among the top 20. At the other end of the spectrum, Hong Kong has the lowest growth rate at 0.2%, followed by Istanbul at 0.3%.

https://www.giuseppedaghino.com/allegati/final-global-destination-cities-index-report.pdf